Resources

On this page you’ll find resources to learn more about the Wisconsin Retirement System, divestment and ways to take action.

How does the Wisconsin Retirement System (WRS) work?

-

More than 652,000 people participate in the WRS, including current and retired employees of state agencies, most local governments and school districts in Wisconsin.

This includes teachers and other school staff, firefighters, police, corrections personnel, DNR employees, state attorneys, UW faculty & staff, nurses and other health care professionals working for the DHS, family members, and many more who work in public service. -

The Wisconsin Department of Employee Trust Funds (ETF) administers our benefit programs as part of the WRS. But they don’t manage how the money is invested.

Learn more: https://etf.wi.gov

-

The State of Wisconsin Investment Board (SWIB) is the state agency responsible for investing the contributions made to the WRS by these employees and their employers to finance their retirements and other benefits.

The WRS has $147.2 Billion in Assets as of Dec. 31, 2021 - one of the largest systems in the U.S.

In addition to the WRS trust funds, SWIB also invests for several other state trust funds including the University of Wisconsin Trust Funds. At the end of 2021, SWIB was managing over $165.6 billion in assets.

Learn more: https://www.swib.state.wi.us

How are our WI Retirement System savings invested? Over $8 billion in fossil fuels.

An analysis of the 2022 WRS holdings by the Climate Safe Pensions Network found that SWIB had invested 4.76% of our pension funds in fossil fuels. That’s over $8 billion dollars funding oil, gas and coal.

2023 Report from Waterloo University shows we don’t need to invest in fossil fuels to fund our pensions

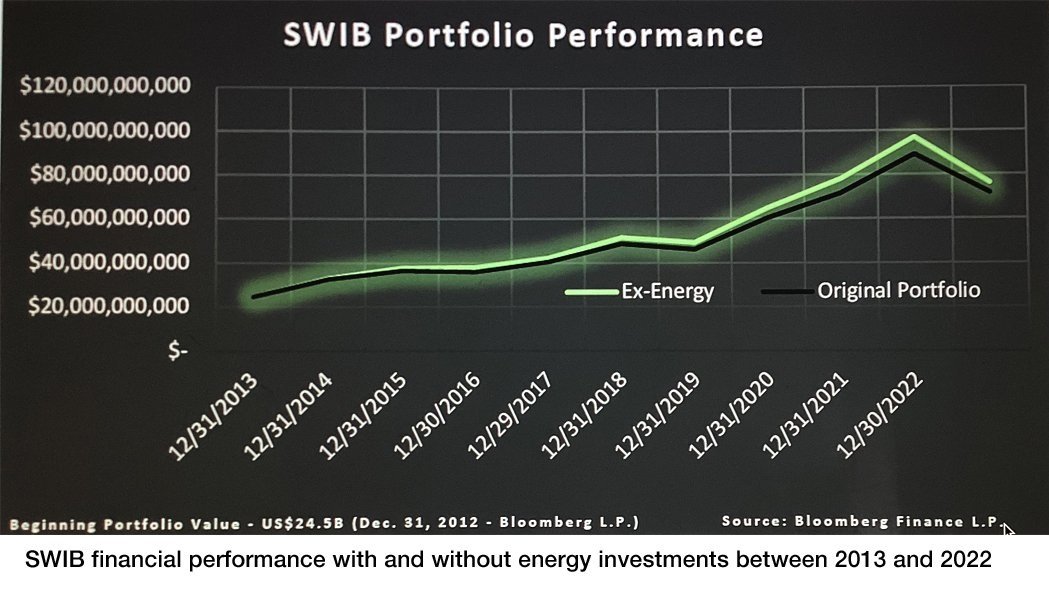

The State of Wisconsin Investment Board (SWIB) lost $4.3 billion by lingering in fossil fuel stocks the past ten years.

That means each Wisconsin Retirement System (WRS) member lost about $6,000.

Why divestment is necessary to safeguard our long-term retirement savings

-

The Financial Case for Fossil Fuel Divestment

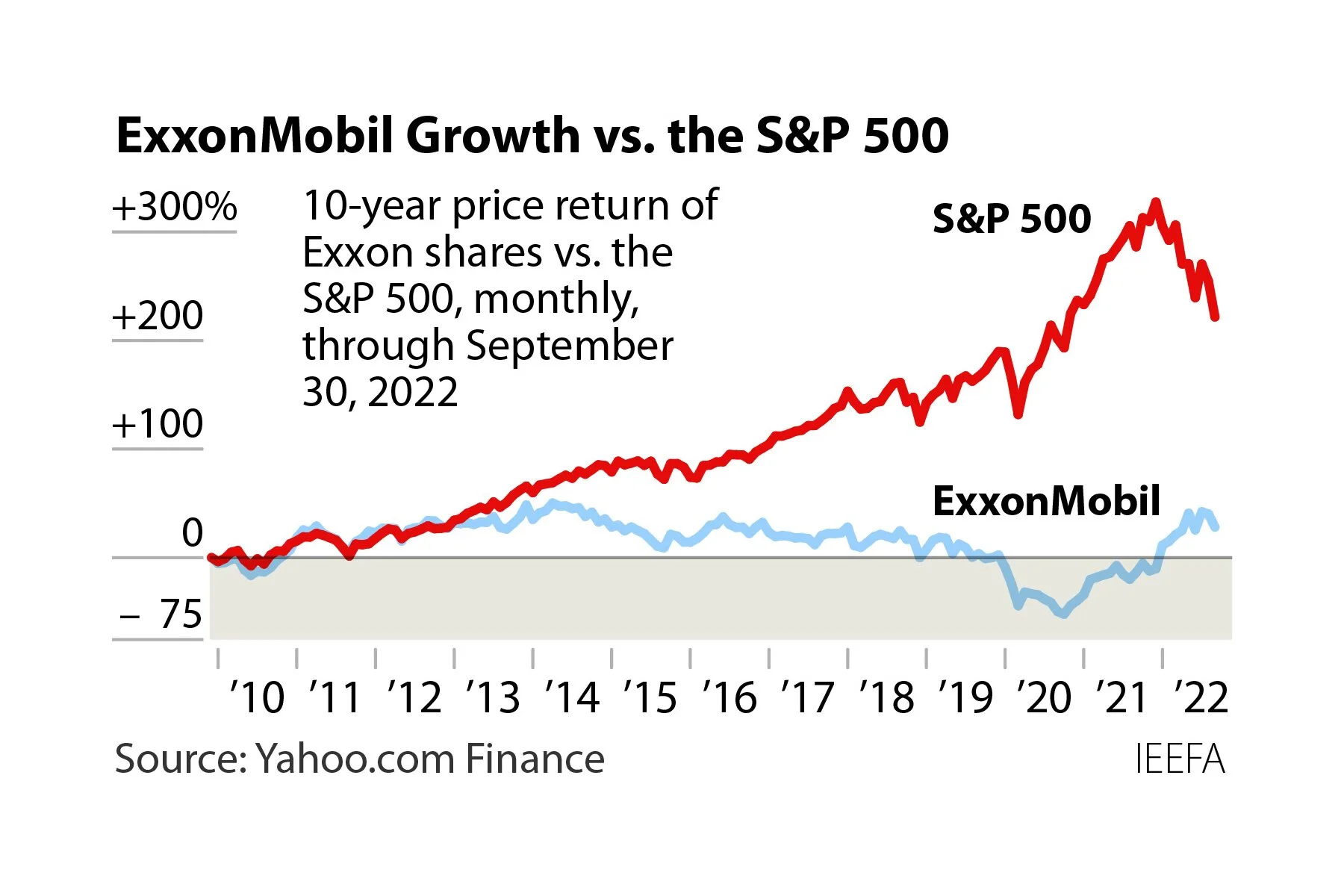

The fossil fuel sector has lost its investment rationale. Divestment from fossil fuels is a defensive move to protect the long-term value of an investment portfolio while continuing to meet investment return targets.

-

Miillions of pensions at risk because investment consultants overlook threat of climate tipping points

Pension funds are risking the retirement savings of millions of people by relying on economic research that ignores critical scientific evidence about the financial risks embedded within a warming climate, warns a report by Professor Steve Keen and the financial think tank Carbon Tracker.

-

The Impact of Energy Investments on the Financial Value and the Carbon Footprint of Pension Funds

New research from the University of Waterloo shows that numerous U.S. public pension funds would be $21 billion richer had they divested from fossil fuels a decade ago. Researchers estimate that the State of Wisconsin Investment Board would be $4.3 billion richer if it had divested.

-

Fossil Fuel funds are now a good option for pensions funds

Analysis from IEEFA finds that low-carbon exposure index funds are outperforming the traditional market benchmarks. Large and small institutional funds can now invest in a plethora of solidly performing low-carbon indexes.

-

Two economies collide: Competition, conflict, cooperation and the financial case for fossil fuel divestment

Once a sound investment strategy, the coal, oil and gas sectors have lost their financial rationale while the case for divestment has proven financially sound and a path for effective climate action, according to a new Institute for Energy Economics and Financial Analysis (IEEFA) report.

-

The Quiet Culprit: Pension Funds Bankrolling the Climate Crisis

Recent report from the Climate Safe Pension Network reveals just 14 U.S. public pension and permanent funds invest nearly $82 billion in fossil fuels.

-

Pensions, Banks and Fossil Fuels

“To protect the climate, we have to stop the fossil fuel companies, and to stop the fossil fuel companies, we have to dry up their sources of money.” Report from STAND, https://www.stand.earth/

It’s possible to divest - many already safely have.

-

Here in Wisconsin, Marquette University's Board of Trustees voted in March of 2022 to prohibit any of its $929 million endowment from being invested directly in public companies conducting oil or natural gas exploration or extraction. The announcement comes nearly a year after a student referendum called on the university to divest from fossil fuels.

Read more: https://www.wpr.org/marquette-university-prohibits-endowment-direct-investments-fossil-fuels?

-

Chicago City Council Bans Fossil-Fuel Investments in Spring of 2022

-

Directed To Divest of Assets Invested in Fossil Fuels law passed and signed by governor in June of 2021.

Read more: https://www.pionline.com/esg/new-maine-law-requires-state-pension-fund-divest-fossil-fuel-companies

-

In April of 2021, Baltimore Mayor Brandon M. Scott signed legislation requiring the city’s three pension funds to divest from the fossil fuel industry.

-

NY Comptroller Stringer and Trustees Announce Successful $3 Billion Divestment from Fossil Fuels - December 22, 2021

And they are investing instead in environmentally friendly investments.

Read more: https://www.pionline.com/esg/3-nyc-pension-funds-report-7-billion-environmentally-friendly-investments

-

1615 institutions with assets of $40.76 Trillion have committed to divest from fossil fuels.

Read more: https://divestmentdatabase.org/https://divestmentdatabase.org/

Help yourself to the tools in our tool bucket, and please reach out if you have questions or need assistance.

Talking Points

To help you share information with your community, workplace, union or organization.

Sample Resolutions

To help you start a conversation about divestment in your organization or union.

Racine Educators United (REU)

Racine Educators United (REU) passed a resolution in the Spring of 2022 supporting efforts to urge the State of Wisconsin Investment Board (SWIB) to exercise its fiduciary responsibility and divest from risky fossil fuel investments.

National American Federation of Teachers

The National American Federation of Teachers (AFT) passed a resolution in July of 2022 calling on TIAA and all other pension fund managers investing educators‘ retirement funds to “divest from fossil fuels and reinvest in workers and communities.”

AFT Local 212

Local 212 (Milwaukee Area Technical College) (REU) passed a resolution in the Fall of 2024 urging the State of Wisconsin Investment Board to Divest from Fossil Fuels and to Reinvest in Workers and Communities.

Write a Letter to the Editor

Write a letter to the editor (LTE) of your local newspaper. Outline the powerful common sense need to divest SWIB’s fossil fuel investments — and add Wisconsin to the growing list of states and institutions that are divesting.

An LTE is your chance to speak to your fellow Wisconsinites, and create a powerful ripple effect.

How to divest your other retirement savings and banking

-

Why move your money?

Bill McKibben explains in “Your Money is Your Carbon”: “If you've got $125k in the financial system, it's doing as much damage as your cooking and your heating and your flying. These are the most important new climate numbers for many years.”

-

Leverage your power as customers

Have money invested in funds such as Vanguard, Fidelity and BlackRock? Join thousands of other investors in demanding that your asset manager provides you with truly sustainable investments that protect our planet and financial future.

-

Invest in TIAA?

Check out TIAA-Divest! Founded in 2019, see what they are doing to press TIAA (Teachers Insurance and Annuity Association of America) to stop investing in fossil fuels and instead turn their responsible investing talk into reality.

-

What about your bank and credit cards?

Join the Third Act Pledge Campaign to use our collective power to influence the big banks (Bank of America, Chase, Citibank and Well Fargo).

-

Stop the Money Pipeline

Lots of resources to help you align your money with your values today, including resources for banking, credit cards, and investment ratings, with step-by-step instructions for changing banks.

-

Fossil free fund search

Use Fossil Free Funds to search your currently held 401(k), retirement plan, or personal portfolio funds for fossil fuel investments, or search for new options if you’re looking to divest.